Why Seniors Move to Shell Point Retirement Community

Learn why Shell Point Retirement Community is a highly sought after Life Plan Community in Fort Myers, Florida and the contract options Shell Point offers.

Discover how seniors pay for their Entry Fees when moving to Shell Point and what seniors have to say in their reviews of Shell Point as a retirement community. Finally, access Shell Point’s non-profit tax returns on this page.

Why do seniors love Shell Point in Fort Myers, Florida?

There are 71 Continuing Care Retirement Communities in Florida. At Second Act we help seniors finance their moves to retirement communities all over the country so we have come to know the various retirement communities seniors love!

Shell Point Retirement Community is one of the largest Continuing Care Retirement Communities in the nation and is a highly sought after retirement destination in Fort Myers Florida. Shell Point was founded in 1968 by The Christian and Missionary Alliance, a Protestant denomination. Shell Point has a Village Church as its spiritual center.

Seniors from all over the country decide to make Shell Point their home. Seniors trust in Shell Point for their retirement and well being as they age because it is a non-profit, serves over 2,500 residents, and is the largest single-site Life Plan Community in the state of Florida. It is a spectacular community in every way possible with an abundance of meaningful things to do providing for an active, vibrant, and meaningful retirement amongst your peers.

Shell Point has an enormous economies of scale advantage. With its size, among its amenities it includes:

- an 18-hole championship golf course

- concerts and world class events on campus

- five restaurants

- a bank on site

- a pharmacy on site

- a guest house motel

- two medical centers

- three assisted living facilities

- one memory care facility and

- fully equipped nursing and rehabilitation facilities.

How do seniors pay for their entry fee at shell point retirement community?

Seniors typically pay for their Entry Fees by selling their home, with a home equity line of credit that can act as a bridge loan such as those provided by us here at Second Act, borrowing against their securities, or withdrawing from their retirement accounts.

To learn more read our blog article titled: Six Ways Senior Fund their Entry Fees in a Life Plan Community or CCRC.

Or download your Funding Guide below!

What Contract Options does Shell Point retirement community Offer?

Shell Point is a Continuing Care Retirement Community offering the benefit and contract options referred to as “Life Care.” We cover the different types of Entry Fees typically offered in Life Care contracts in our Guide we encourage you to download here.

Life Care provides the peace of mind of knowing that as you get older should you need care, Shell Point’s Health Services will be there to help cover your future healthcare needs, such as Assisted Living or Skilled Nursing Care. In addition, home health aids and rehabilitation are also available should you have a need.

Shell Point has over 40 floor plans with four different types of Life Care Contracts. Their A-75 Contract and C-Fee For Service Contracts provide a partial or full refund of your Entry Fee to your Estate. Shell Point’s Type A contract and type B contract, while not refundable, also provide an extensive array of supportive services. Shell Point’s floor plans and costs can be found on its pricing page here.

bridge loan solutions

2. It is easier to stage, show and sell your home for the best price if you are not living in it.

| Month | Monthly Payment | Cumulative Balance |

|---|

What do senior reviews say about Shell Point retirement community?

Reviews:

Shell Point’s Reviews are top notch. It is rare to find a bad review on Shell Point or its people. Overall Shell Point has very positive reviews:

» Google Reviews indicate an almost 5-star rating.

» Shell Point has accumulated countless awards over the decades it has been in service. For a list of their recognition of excellent service, visit their Awards page here.

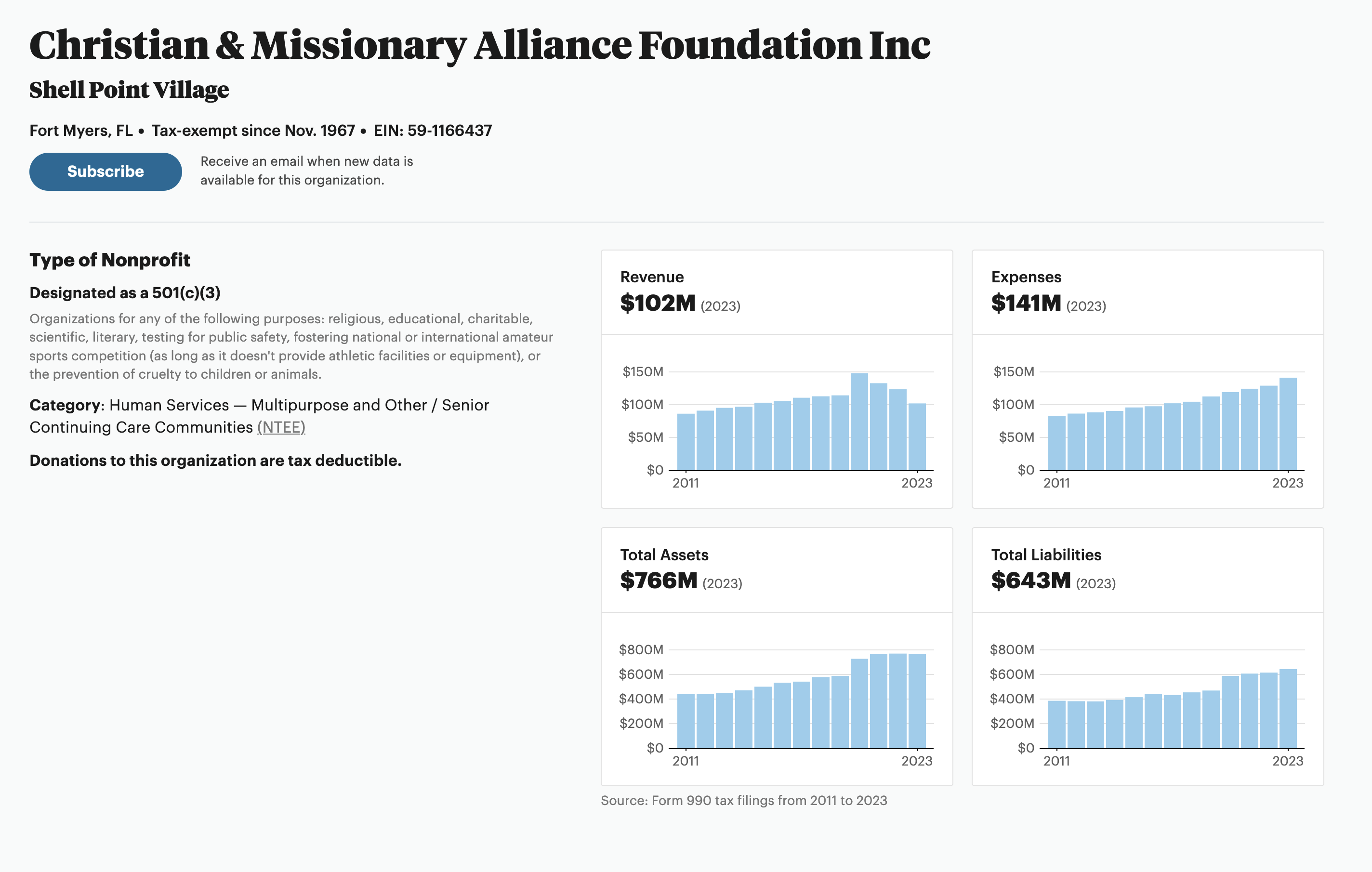

do i have the right to ask for shell point’s tax return and financial standing?

As a non-profit, Shell Point’s tax returns and financial snapshot are publicly available information. Below is a snapshot of Shell Point’s overall tax return and financial position.

Click on the pictures below for a link to Pro-Publica’s Non-Profit Explorer. There you can download the complete and detailed information on Shell Point Retirement Community. Be sure to ask the community for their latest copy. When visiting a CCRC in Florida you have a right to ask for the community’s financial statements and tax returns in order to assess its financial viability.

The Florida Office of Insurance Regulation, or Floir, regulates all Entry Fee Life Plan and Continuing Care Retirement communities. If you have any questions about inspection reports or other supervisory reports the office may have for Shell Point Retirement Community, contact Floir staff directly at:

Regulation:

Florida Office of Insurance Regulation

Consumer Helpline Instate: 1-877-693-5236

Consumer Helpline Out of State: 850-413-3089

Email: consumer.services@myfloridacfo.com

Website: https://floir.com/consumers