Recently Newsweek embarked on an effort to identify and rank the 250 best Life Plan Communities and Continuing Care Retirement Communities (also referred to as a CCRC), across the USA. Eighteen of these communities are in Illinois. Learn which communities were ranked and download your free Funding Guide on how to pay for a move to a Life Plan Community or CCRC.

Overview

At Second Act Financial Services, we specialize in helping seniors fund their Entry Fees through convenient bridge financing which we discuss more in detail below. Working with thousands of retirement communities across the USA our clients often tell us which communities they love. Recently, Newsweek embarked on an effort to rank the 250 best Continuing Care Retirement Communities and Life Plan Communities across the USA. Eighteen of those communities are in Illinois.

In this blog we review what is a Life Plan Community or CCRC, how seniors pay for their Entry Fees in such communities, and we provide a brief overview on each of the 18 communities ranked by Newsweek.

It is important to note that just because a community is not ranked, it can still be an excellent community. We added one such community Oak Trace, a Lifespace Community, a CCRC we know well!

What is a Continuing Care Retirement Community (CCRC) or Life Plan Community?

Life Plan Communities are sought after by those who want an active, engaging, vibrant retirement lifestyle, along with the peace of mind of having a full continuum of care available as needed.

Most life plan communities offer a large campus-like setting providing housing, hospitality services, and amenities to independent and active seniors, along with care services that are available as needed, typically including assisted living, memory care and skilled nursing care.

Around three-quarters of all life plan communities as we discuss in a separate blog require an entry fee, which may be partially to fully refundable to one’s estate, and possibly sooner if the resident vacates the unit. The other approximately 25% of life plan communities operate either on a rental-only basis or an equity (or co-op) ownership model whereby you own your home or a share of the community’s corporation, but still pay monthly fees for the available services.

How do seniors fund their move to a Life Plan Community or CCRC in Illinois?

Seniors typically sell their home, take advantage of bridge loans to help them move into their retirement community first and have time to sell their existing home, draw down from retirement accounts, sometimes may temporarily borrow from their existing securities (commonly called to a margin loan), or sell a life insurance policy they don’t need.

Be sure to download your free Funding Guide to review the details of what CCRCs are, their contracts, along with a little more detail on how seniors pay for their Entry Fees as they move to a Continuing Care Retirement Community or Life Plan Community.

Which are the eighteen best Life Plan Communities and Continuing Care Retirement Communities in Illinois according to Newsweek?

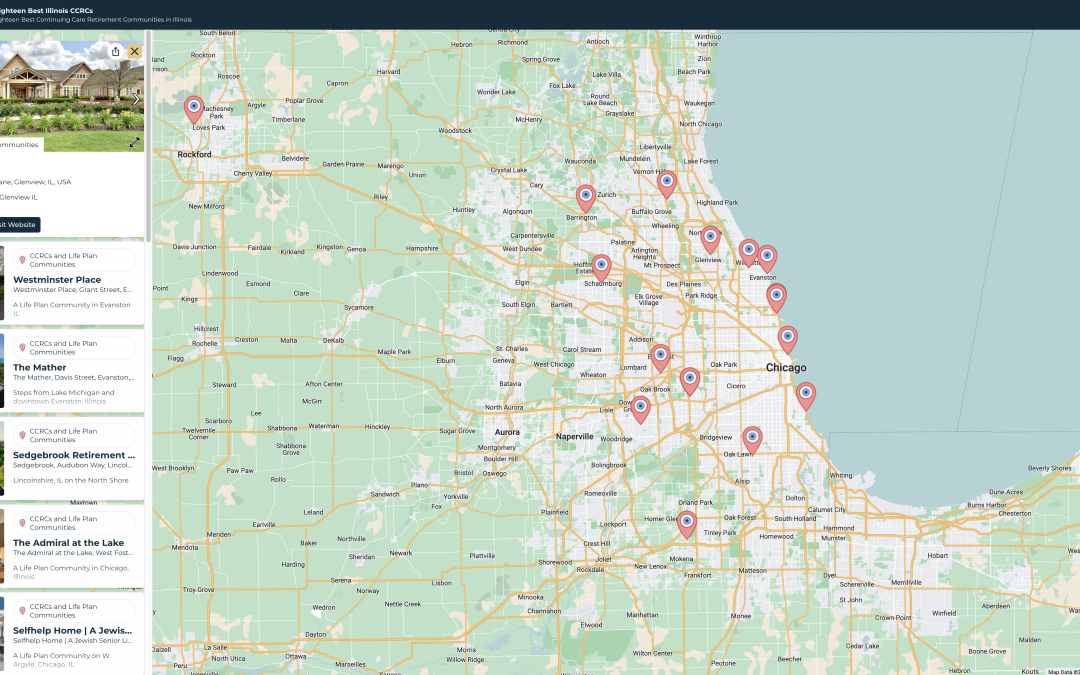

According to Newsweek, the following are the best eighteen Life Plan and Continuing Care Retirement Communities in the state of Illinois. Below this table we provide a useful map that helps you see where each community is located:

| Illinois Rank |

Life Plan Community | Score | City | National Rank |

| 1 | The Admiral at the Lake | 82.41% | Chicago | 7 |

| 2 | Sedgebrook | 74.03% | Lincolnshire | 32 |

| 3 | Mercy Circle | 73.09% | Chicago | 43 |

| 4 | Wesley Willows | 72.25% | Rockford | 60 |

| 5 | Montgomery Place | 71.90% | Chicago | 70 |

| 6 | Friendship Village of Schaumburg | 71.50% | Schaumburg | 81 |

| 7 | The Mather | 71.28% | Evanston | 85 |

| 8 | Providence Life Services – Park Place of Elmhurst | 70.89% | Elmhurst | 90 |

| 9 | ClarkLindsey | 70.85% | Urbana | 92 |

| 10 | Vi at The Glen | 70.78% | Glenview | 95 |

| 11 | The Selfhelp Home | 69.70% | Chicago | 114 |

| 12 | Lutheran Senior Services – Concordia Village | 69.03% | Springfield | 124 |

| 13 | Presbyterian Homes – Westminster Place | 68.30% | Evanston | 145 |

| 14 | Smith Senior Living Community – Smith Crossing | 68.12% | Orland Park | 154 |

| 15 | The Clare | 67.72% | Chicago | 164 |

| 16 | Lutheran Senior Services – Meridian Village | 67.62% | Glen Carbon | 169 |

| 17 | Plymouth Place | 65.37% | La Grange Park | 231 |

| 18 | The Garlands of Barrington | 65.09% | Barrington | 241 |

Another community we here at Second Act know well that receives excellent reviews from its residents, is Oak Trace Retirement Community in Downers Grove, IL. Oak Trace is part of Lifespace Communities, a non-profit system with sixteen communities nationwide offering the meaningful living with the benefits of Life Care.

Who regulates CCRCs and Life Plan Communities in Illinois?

The Illinois Life Care Facilities Act authorizes the Illinois Department of Public Health to regulate residency agreements referred to as “Life Care Contracts”. As previously discussed, Life Care Contracts require an Entry Fee, and in return provide a continuum of care including personal, nursing, or medical care in addition to the residency arrangement.

Approximately 90 communities in the state of Illinois hold one or more permis to entre into Life Care Contracts according to the Illinois Department of Health.

For Additional Information, visit the Illinois Department of Health Life Care Facilities Program page, here.

Important Disclaimer

The information in this page is not meant to serve as financial, tax, or personal financial planning advice. No decisions should be made from reading the information on this page. Decisions should be made after careful analysis and consultation with your financial, tax, accounting, or other professional advisor licensed to provide retirement advice. Second Act is a Division of Liberty Savings Bank, F.S.B. Member FDIC. Lending and loan services provided by Liberty Savings Bank, F.S.B. NMLS # 408905. Equal Housing Lender. All other services provided by Second Act Financial Services, LLC. This information is current as of 1/01/2024. Subject to credit and loan approval. Conditions and limitations apply. Information, rates and terms are subject to change without notice. © 2024 Second Act Financial Services, LLC. All Rights Reserved.

Recent Comments