From Westminster Shores and Westminster Suncoast to the Masonic Home of Florida and Westminster Palms, learn about the four best Continuing Care Retirement Communities (also known as CCRCs or Life Plan Communities) in St. Petersburg Florida, how seniors pay for their Entry Fees in these types of communities, and download a helpful Funding Guide.

What is a Continuing Care Retirement Community (CCRC) or Life Plan Community?

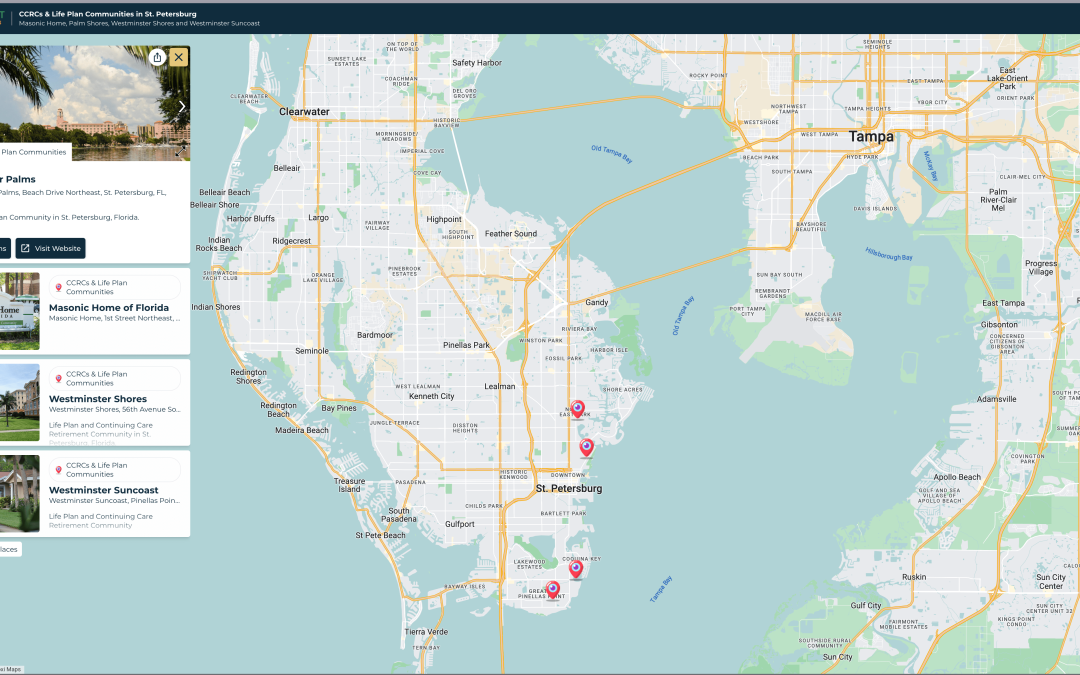

Searching for a Continuing Care Retirement Community (CCRC) also known as a Life Plan Community in St. Petersburg, can be tricky. Many websites talk about these communities but often co-mingle the information with other communities that are not true CCRCs. In this article we provide an orientation to the four best Continuing Care Retirement Communities in St. Petersburg, Florida, along with a helpful map showing where each of these communities are located and links to each of their websites.

Life Plan and Continuing Care Retirement Communities offer a large campus-like setting providing housing, hospitality services, and amenities to independent and active seniors, along with care services that are available as needed, typically including assisted living, memory care and skilled nursing care.

Around three-quarters of all life plan communities require an entry fee, which may be partially to fully refundable to one’s estate, and possibly sooner if the resident vacates the unit. The other approximately 25% of life plan communities operate either on a rental-only basis or an equity (or co-op) ownership model whereby you own your home or a share of the community’s corporation, but still pay monthly fees for the available services. If a full continuum of care is not provided it is likely not a CCRC or Life Plan Community.

Why Seniors Find CCRCs and Life Plan Communities Attractive.

Life Enrichment:

Today’s Life Plan Communities (also known as Continuing Care Retirement Communities or CCRCs) can enrich your life in many ways. Studies show that living home alone or feeling socially isolated presents a higher risk of heart disease or depression. Having a sense of community, of safety, and waking up every morning to a vibrant, active, meaningful life, can have a big impact on your quality of life. These communities often feel like high end high service resorts with no shortage of meaningful engagement for a healthy body and healthy mind.

Care for Life:

In addition, a seminal aspect of CCRCs is the “Life Care” contract which provides you with the opportunity to lock in future healthcare needs at today’s costs. This can bring predictability and peace of mind to your financial and health planning. As you age, if you are in need of assistance, there is often on the same campus the option of Assisted Living, Memory Care or Skilled Nursing Care, making it attractive especially for couples living together. This insurance element to a CCRC Entry Fee is why Continuing Care Retirement Communities are heavily supervised and regulated by the Florida Office of Insurance Regulation, or Floir, for short.

Toward the end of this blog article we provide a link to Floir’s offices along with the office’s contact information.

How do seniors pay for their Entry Fees in CCRCs or Life Plan Communities in St. Petersburg, Florida?

Most seniors usually sell their home and use the cash proceeds from their home sale to pay for their Entry Fee. For those seniors who would like to move into a CCRC first and enjoy the benefit of time to prepare, list and sell their home, a Home Equity Line of Credit for Senior Living such as the one offered by Second Act can act as a bridge loan for your CCRC entry fee. And yet others draw down from retirement accounts or borrow from their securities through what is called a Margin Loan.

The Four Continuing Care Retirement Communities in St. Petersburg, Florida are:

According to the Florida Department of Insurance Regulation, there are four Continuing Care Retirement Communities (also known as Life Plan Communities) in St. Petersburg, Florida, with two more within a short driving distance within Lee County:

Westminster Palms

939 Beach Drive NE

St. Petersburg, FL 33701

(877) 399-0266

Westminster Shores

125 56th Ave. South

St. Petersburg, FL 33705

(877) 753-0032

Westminster Suncoast

1095 Pinellas Point Drive South

St. Petersburg, FL 33705

(877) 382-0113

Masonic Home of Florida

1333 Santa Barbara Boulevard

Cape Coral, Florida, 33991

(239) 454-2231

All four of these communities are known as Continuing Care Retirement Communities or Life Plan Communities. All have strong reputations in St. Petersburg and are highly sought after both by residents in the area, as well as snowbirds up north. We encourage you to visit each of these retirement communities’ websites to learn more and get comfortable with their operating model. When you need financing to fund your Entry Fee, the friendly folks at Second Act will be here to assist!

Often Not More Expensive than Living at Home:

It is tempting to think that living at home is “free”. But when you sit down to do the math and calculate all the expenses as well as time and effort that it takes to maintain the home and stay healthy at home, you may begin to see that Continuing Care Retirement Communities and Life Plan Communities can be a good value.

Take a look at the table below for a true comparison of the costs of living at home compared to the costs of a CCRC and what it can offer you in lifestyle, peace of mind, predictable healthcare costs, and a meaningful, vibrant, engaging life. But math is only half the story. Emotional happiness that comes from engagement is also important. And can you truly put a price on that?

Who regulates Continuing Care Retirement Communities in the State of Florida?

CCRCs with Entry Fees are primarily regulated by the Florida Office of Insurance Regulation or Floir, for short. This is because paying an Entry Fee is akin to obtaining insurance for your long-term care. Typically you move into a CCRC when you are independent and pass a health assessment. As you get older and need care, these communities offer assisted living, memory care, and skilled nursing care.

About Second Act Financial Services

At Second Act Financial Services, we specialize in navigating CCRC financing needs. Our team brings extensive experience in retirement and banking solutions, focusing on home sale solutions, home equity lines of credit that can serve as bridge loan solutions, and connections to veteran benefits, long-term care insurance or life settlement resources. We help you understand your options for managing CCRC entry fees and provide support with our financial options every step of the way. Our proven track record in assisting clients with their retirement financing needs reflects our commitment to your financial well-being. Trust us to guide you with expertise as you plan for life in your chosen retirement community. For more information on how we can assist you, visit Second Act Financial Services.

Important Disclaimer

The information in this page is not meant to serve as financial, tax, or personal financial planning advice. No decisions should be made from reading the information on this page. Decisions should be made after careful analysis and consultation with your financial, tax, accounting, or other professional advisor licensed to provide retirement advice. Second Act is a Division of Liberty Savings Bank, F.S.B. Member FDIC. Lending and loan services provided by Liberty Savings Bank, F.S.B. NMLS # 408905. Equal Housing Lender. All other services provided by Second Act Financial Services, LLC. This information is current as of 1/01/2024. Subject to credit and loan approval. Conditions and limitations apply. Information, rates and terms are subject to change without notice. © 2024 Second Act Financial Services, LLC. All Rights Reserved.

Recent Comments