Shell Point Retirement Community is one of the largest, well known, and highly respected Continuing Care Retirement Communities in the nation. Seniors from all over the USA move to Shell Point. Learn what seniors love about Shell Point, six ways seniors fund their Entry Fee when moving to this prestigious community, and download a helpful Funding Guide.

Shell Point is Highly Sought After and Nationally Recognized.

At Second Act Financial Services, we specialize in helping seniors fund their Entry Fees through convenient bridge financing which we discuss more in detail below. Working with thousands of retirement communities across the USA our clients often tell us which communities they love.

Shell Point is one such community! Seniors from all across the USA make the move to Shell Point. And one such question we hear all the time is “But how do I fund my Entry Fee?” We answer this question in today’s blog.

First, why do Seniors Love Shell Point?

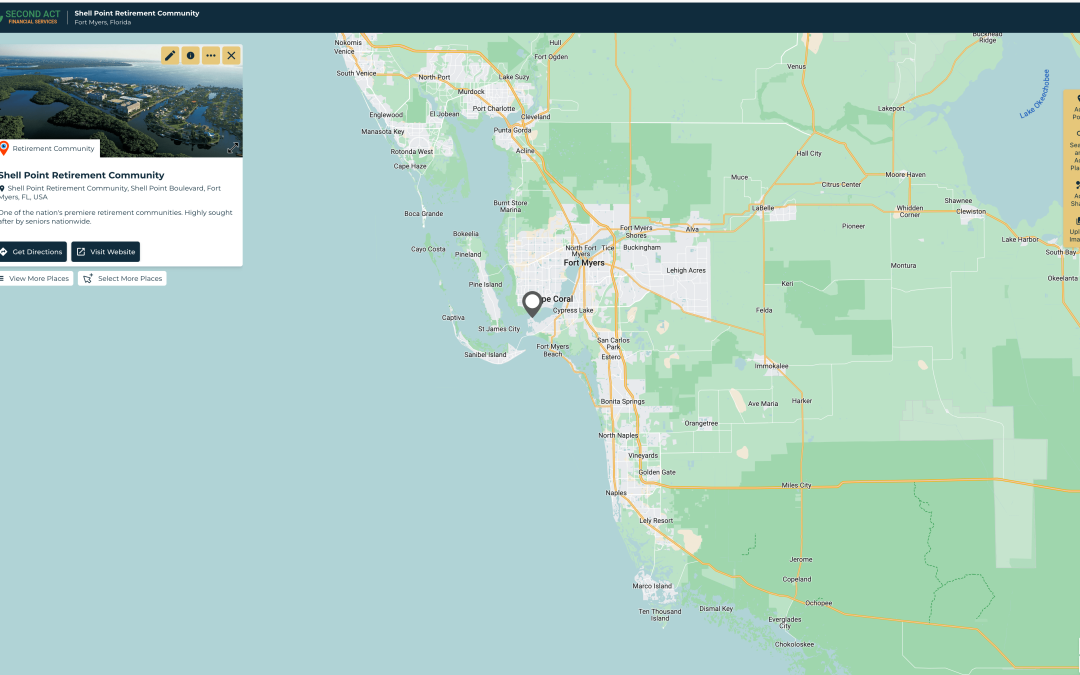

When it comes to finding that ‘just perfect’ place to enjoy retirement in Florida, there is no shortage of choices. In conversations, one name seems to always stand out among the rest: Shell Point Retirement Community. Comprising over 700 stunning and beautiful acres in Fort Myers, Florida, Shell Point offers an exceptional blend of amenities and natural beauty, with an active community that has captured the hearts of its residents and the greater Fort Myers community.

Breathtaking Location:

Upon driving into the community grounds you immediately realize that one of the brightest attributes of Shell Point is its breathtaking location. Along the Caloosahatchee River and near the Gulf of Mexico, Shell Point presents a dazzling panoramic view along the waterfront. From early morning walks by the river, sunset cruises, to just sitting by the beautiful gulf waters, relaxation and fun are just a few of the rejuvinating experiences you will enjoy amid the natural surroundings.

Exceptional Commitment to Wellness with Health Care Services when Needed:

Wellness is a core focus for everyone at Shell Point. The community provides numerous resources to support residents’ physical, mental, and emotional well-being. Shell Point’s state-of-the-art fitness center offers classes tailored to seniors. Countless wellness programs emphasize holistic health encouraging residents to lead balanced and healthy lives.

Shell Point offers a full continuum of care, including independent living, assisted living, skilled nursing, and memory care. This comprehensive approach ensures you receive the care you need as you age, without having to leave the community you love.

Vast and Impressive Array of Amenities.

Shell Point offers an impressive array of amenities that cater to the diverse interests of its residents. The community features multiple dining options, including fine dining restaurants and casual cafes. Swim along one of its many beaches or enjoy swimming pools, golf courses, and tennis courts. Shell Point even has a marina for boating enthusiasts.

The on-site performing arts center hosts concerts, lectures, and performances, providing endless entertainment options.

Natural Beauty and Conservation:

Shell Point is a nature lover’s paradise. The community is home to lush landscaping, nature preserves, and walking trails that allow residents to connect with the environment. The blend of beautifully maintained gardens and natural Florida landscapes creates a one of a kind life as a resident in the community.

Continuing Education and Spiritual Enrichment:

Lifelong learning is a priority at Shell Point, where you can take advantage of a variety of educational opportunities. The Shell Point Academy of Lifelong Learning offers classes on a wide range of topics, from history and science to art and technology. These programs allow residents to continue exploring new interests and staying intellectually engaged.

Taking care of the spirit is also important for many of the residents at Shell Point. Shell Point offers a variety of religious services and spiritual programs. The community has a strong interfaith presence, with a chapel that hosts regular worship services, Bible studies, and spiritual counseling. The inclusive atmosphere ensures that residents from all faith backgrounds feel supported and uplifted.

Now that you have learned a little about what makes Shell Point a spectacular retirement destination, how exactly do you fund your Entry Fee to this wonderful community?

Six Ways Seniors Fund their Entry Fees at Shell Point and other similar retirement communities.

Download our free Guide here to learn about contract types offered by CCRCs and how seniors pay for their Entry Fee at Shell Point and similar communities. Be sure to share this Guide with your family or professional financial advisors because they too will find it helpful!

1. Sale of Your Home:

Many seniors use the proceeds from the sale of their home as their “Entry” to Shell Point. This strategy is very common, if not the most common way, seniors fund their Entry Fee at Shell Point and other Communities across the nation. But preparing the home for sale takes time.

Second Act Financial Services can connect you with the right real estate professionals who understand senior move management and can help coordinate the details for you at no charge. Whether you utilize the free assistance that can be provided by Second Act Financial Services or your own local realtor, be sure to follow these key points:

Always use experienced and reputable real estate agents. Not agents that are very part time. Sometimes your friend may not be the best agent. Make lists of what you want to keep, donate, and let go. Does the home need any repairs? It is important to work with a local agent who will help you find the handymen you need.

At Second Act we work to find agents willing to go the extra mile who will:

− Take professional photographs

− Help you de-clutter

− Properly stage and list your home

− Help you with your packing and moving

− Ensure you are comfortably moved into your new home

Enjoy life in your new community, while the Second Act Financial Services professionals work on your behalf and report to you every step of the way! Call 888.999.7372 for immediate and prioritized assistance in selling your home.

2. Bridge Financing:

Most seniors usually sell their home and use the cash proceeds from their home sale to pay for their Entry Fee. For those seniors who would like to move into a CCRC first and enjoy the benefit of time to prepare, list and sell their home, a Home Equity Line of Credit for Senior Living such as the one offered by Second Act can act as a bridge loan for your CCRC entry fee. It is easier to clean, prepare, stage, list, and sell your home for the best price if you are not living in it.

How Second Act Bridge Loan Financing for Works:

– Apply for an overall line of credit amount.

– Draw what you need to fund your community’s Entrance Fee and monthly service fees.

– Make much smaller, interest-only payments on your outstanding balance.

– Enables you to enjoy the benefit of time so you can prepare and sell your home for the highest and best price.

– Pay back your line of credit when you have sold your home.

Seniors find it helpful to know that bridge financing is an often-used financial tool to help you move now while giving you the benefit of time to sell your home for the highest and best possible price.

Call 888.999.7372 to see if bridge financing by Second Act could be of help to you and to receive special, prioritized service.

3. Withdraws from Your Retirement Accounts:

There are many different types of retirement accounts, such as traditional IRAs, Roth IRAs, 401ks, and more. You may own more than one type of retirement account. When considering a withdrawal from a retirement account we strongly recommend a review of your options with a tax accountant and financial advisor before making any decisions. Large withdrawals from most IRAs (with the exception of Roth) will typically trigger a large income tax bill — potentially at a higher tax rate, and may also trigger a Medicare surcharge. A few hours of time with a tax professional could save you a lot of money in unexpected tax consequences.

First Step: Take Inventory of Your Accounts

The tax impact and potential withdrawal penalties vary by the type of retirement account. The first step in determining your options for potential withdrawals is to understand which types of accounts you have.

Be sure to visit www.secondact.com/LifePlan to learn about all the various types of retirement accounts, along with the most recent limits and details. While the page is not tax or financial advice, it can give you a good baseline for a conversation with professionals who specialize in tax and retirement account management.

It is important before you withdraw from any retirement accounts to get professional guidance . The most important step when it comes to potential withdrawals from an account is to make sure you consult a tax professional first. Before you visit with your tax and financial advisors, review the account withdrawal tax considerations for your retirement account types at www.secondact.com/LifePlan.

4. “Margin Loans” – A Loan based on the value of your securities

If you have a sizeable investment account with a large brokerage firm, you may be able to obtain cash quickly by borrowing against their value. How much you can borrow depends on the firm. In some cases, you may be able to borrow up to 70% or more of the value of the underlying securities you post as collateral, depending on the size of the account. Sometimes referred to as a “portfolio loan” or a “securities-backed line-of-credit,” many investment and brokerage houses offer this kind of loan.

How does an investment loan work?

You select the securities you would like to borrow against, although there are restrictions. You then decide what percentage to borrow against, up to the maximum percentage allowed. The brokerage firm provides you with a Line of Credit that you can draw upon up to the approved credit limit. Funds are typically made available for use within days.

What are the pros and cons?

In a volatile market, large securities-backed loans can be somewhat risky because if the value of your account declines, you may have to post more collateral to keep the borrowing ratio in your loan agreement. Many seniors do not want the unpredictability that comes with a securities loan and opt for a Home Equity Line of Credit in its place. However, if the loan amount is relatively small compared to the overall account value, then the risk may be lower.

Many people do not realize that they can possibly take out a loan with their securities (investments such as stocks and mutual funds) serving as collateral. The amount you can borrow varies and depends on the parameters set by the investment or brokerage firm.

Typically, the securities loaned against cannot be sold or traded until the loan is paid back. And if the value of the securities declines past a certain amount you may have to post more collateral.

5. Sale of Your Securities:

Selling securities is also an often utilized approach to funding your Entry Fee. But be mindful because large and unintended tax consequences are not only triggered by withdrawals from retirement accounts, but potentially from other investments you hold, such as stocks, mutual funds, and ETFs which you decide you want to sell.

The amount of time you’ve held the shares, which shares you choose to sell, whether there is a gain or loss, and timing of the sale can all make a big difference in the potential tax due.

As of September 2024 the short-term capital gains tax is your ordinary income tax rate which ranges from 0% to 37%. And the long-term capital gains tax rate ranges between 0% – 20% again depending on your Adjusted Gross Income for the year.

6. Sale or Borrow from Your Life Insurance:

Life insurance is often purchased during the income-earning years so if the unexpected happens the survivors have adequate cash on hand to replace lost income and cover debt burdens. But as circumstances evolve, you may no longer have as much of a need for coverage.

If you find this to be the case, then your life insurance policy may be an asset you can tap into or even sell for cash. The possible options include:

Life Settlement

The most common life settlement solution is an all-cash lump-sum payment to the policy owner where the purchaser takes over all future premium obligations and becomes the beneficiary

Exchange to an Annuity

You may be able to do a tax-free 1035 exchange of your life insurance policy into an annuity, which can then be used to provide a guaranteed income stream for a period or for life. This may not necessarily help pay the entry fee directly, but it may help replace income that otherwise would have come from other assets you choose to sell.

Long-Term Care Benefit

Many life insurance policies include a rider for long-term care insurance. Yet, there are other types of hybrid policies available that still provide life insurance but also include substantially more coverage for long-term care. You may have the option to convert your life insurance policy to a hybrid policy if it makes sense for your unique situation and financial plans.

Retained Benefit

You may also decide to keep a portion of your coverage intact with no future premium obligations.

If you have a life insurance policy in the amount of $100,000 or greater and want to explore your options, call the Second Act Financial Services number below for prioritized service.

Call 888.999.7372 to be connected to a life insurance sale options for your consideration with prioritized care and service.

Important Disclaimer

The information in this page is not meant to serve as financial, tax, or personal financial planning advice. No decisions should be made from reading the information on this page. Decisions should be made after careful analysis and consultation with your financial, tax, accounting, or other professional advisor licensed to provide retirement advice. Second Act is a Division of Liberty Savings Bank, F.S.B. Member FDIC. Lending and loan services provided by Liberty Savings Bank, F.S.B. NMLS # 408905. Equal Housing Lender. All other services provided by Second Act Financial Services, LLC. This information is current as of 1/01/2024. Subject to credit and loan approval. Conditions and limitations apply. Information, rates and terms are subject to change without notice. © 2024 Second Act Financial Services, LLC. All Rights Reserved.

Recent Comments